The Southeast Asian Iron and Steel Association (SEAISI) recently said that by 2026, crude steel production in Southeast Asia may increase by 90.8 million tons, an increase of nearly 1.3 times.

Crude steel production in Southeast Asia in 2020 is 71.8 million tons per year, and assuming all projects are completed on schedule, the region’s total crude steel production is expected to increase to 162.6 million tons per year by 2026.

The Southeast Asian Iron and Steel Association said growth in crude steel production will be concentrated in Indonesia, Malaysia and Vietnam, with Chinese investment in these projects.

One of the major projects is the new joint steel plant project of Wen An Steel Company in the Samalaju Industrial Park, Bintulu, Sarawak, Malaysia. Production will begin at the end of the year, when most of the output will be exported.

In terms of products, the production capacity of hot-rolled products is expected to increase from the current approximately 101.4 million tons/year to 190.6 million tons/year in 2026, which indicates that there will be an oversupply in the future, and Southeast Asia will become the main export area of steel products.

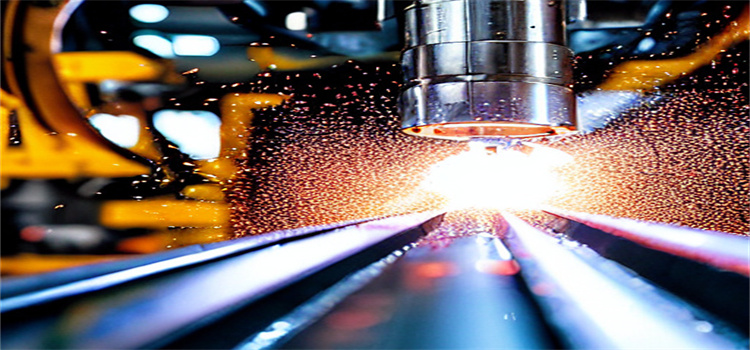

According to the Southeast Asia Iron and Steel Association, with the increase in steel production capacity, the steelmaking process in Southeast Asia will shift from the electric arc furnace to the blast furnace-converter (BF-BOF) process. The rapid implementation of large blast furnace steel plant projects means that CO2 emissions will increase.

At present, about 48 million tons/year of steel production in Southeast Asia is based on electric arc furnaces, and about 22 million tons/year adopts the blast furnace-converter route.

By 2026, EAF steel production is expected to reach about 51 million tons/year, while blast furnace steel production will increase by more than 2.6 times to about 80 million tons/year.

As carbon dioxide emissions increase, the increased carbon emissions will be eliminated through the introduction of carbon capture, utilization and storage (CCUS) technologies.

The ASEAN Energy Centre (ACE) forecasts that carbon emissions will increase to 4.171 GtCO2e by 2040, up from 1.686 GtCO2e in 2017.

In January 2022, Petronas conducted a joint study with Sarawak Shell to enhance carbon capture and storage (CCS) capacity.

Shortly before this, Petronas also collaborated with POSCO to study opportunities to unlock the potential of CCS and to identify suitable technologies in carbon dioxide capture, transport, storage and potential applications.

CCUS can open up new opportunities by applying a commercial-scale carbon dioxide-to-methanol process.

However, the Southeast Asian Iron and Steel Association said investment in steelmaking capacity in Southeast Asia also faced multiple challenges, which forced the delay of several projects.

The COVID-19 pandemic, which began in late 2019, remains one of the biggest challenges. The implementation of several joint venture projects in the region has been delayed by the lack of manpower due to China’s epidemic lockdown measures, and Chinese employees have the expertise and are key to the advancement of many projects.

Another factor is the risk of low profit margins due to competition from structural excesses in steel products in the region.

In this regard, the Southeast Asian Iron and Steel Association suggested that it would be a win-win solution to invest in areas with less competition, such as high value-added products such as stainless steel.

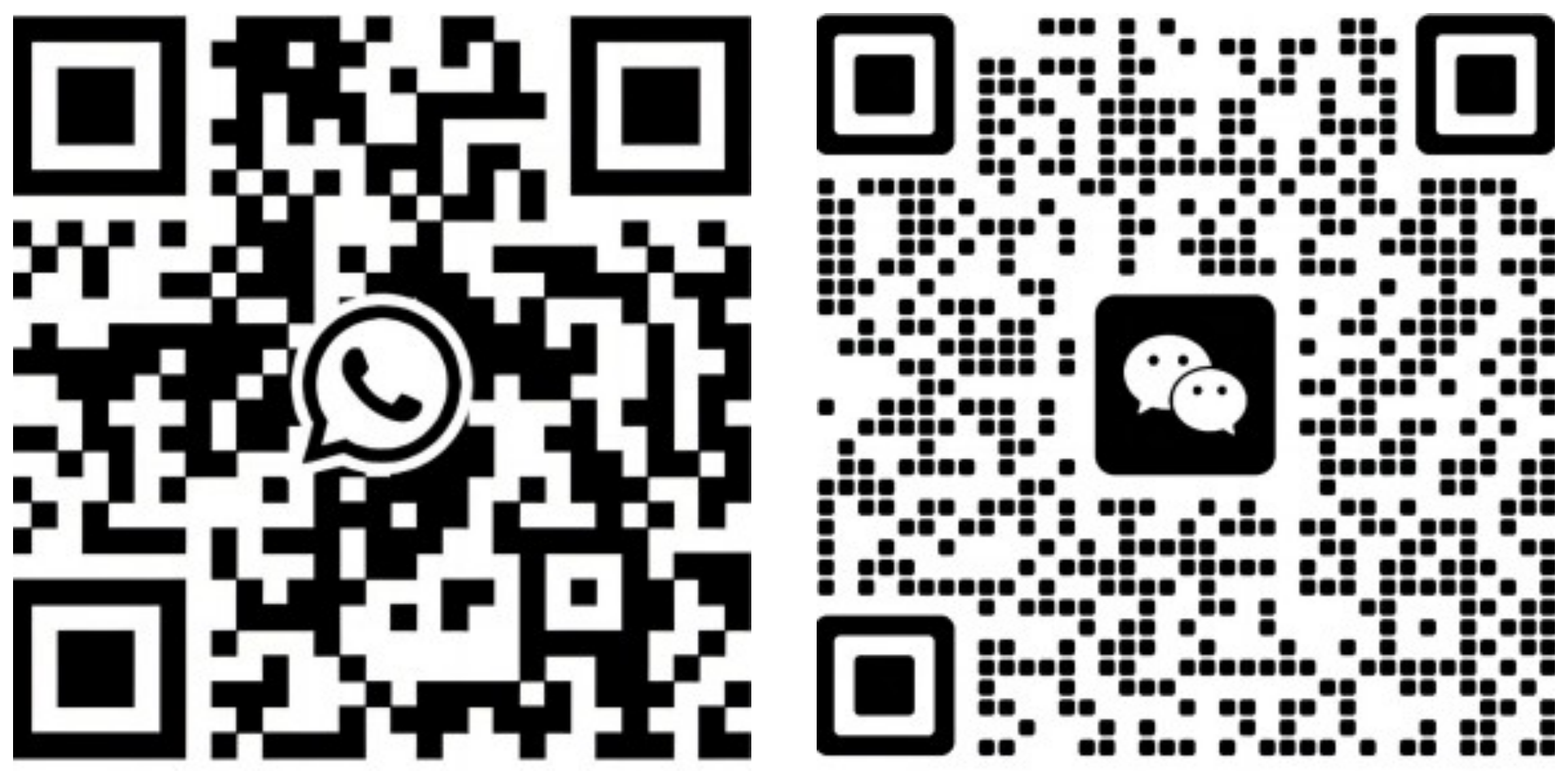

If you would like to know more, please ask our customer service.