In 2023, Chinese nickel buyers will seek Shanghai rather than LME pricing

Post Time 2022/12/14

Based on the news on December 8, 2022, two people who knew the matter directly said that China’s nickel buyer (the world’s largest nickel buyer) had asked the manufacturer to use the Shanghai Futures Exchange (SHFE) contract instead to price the supply for next year.

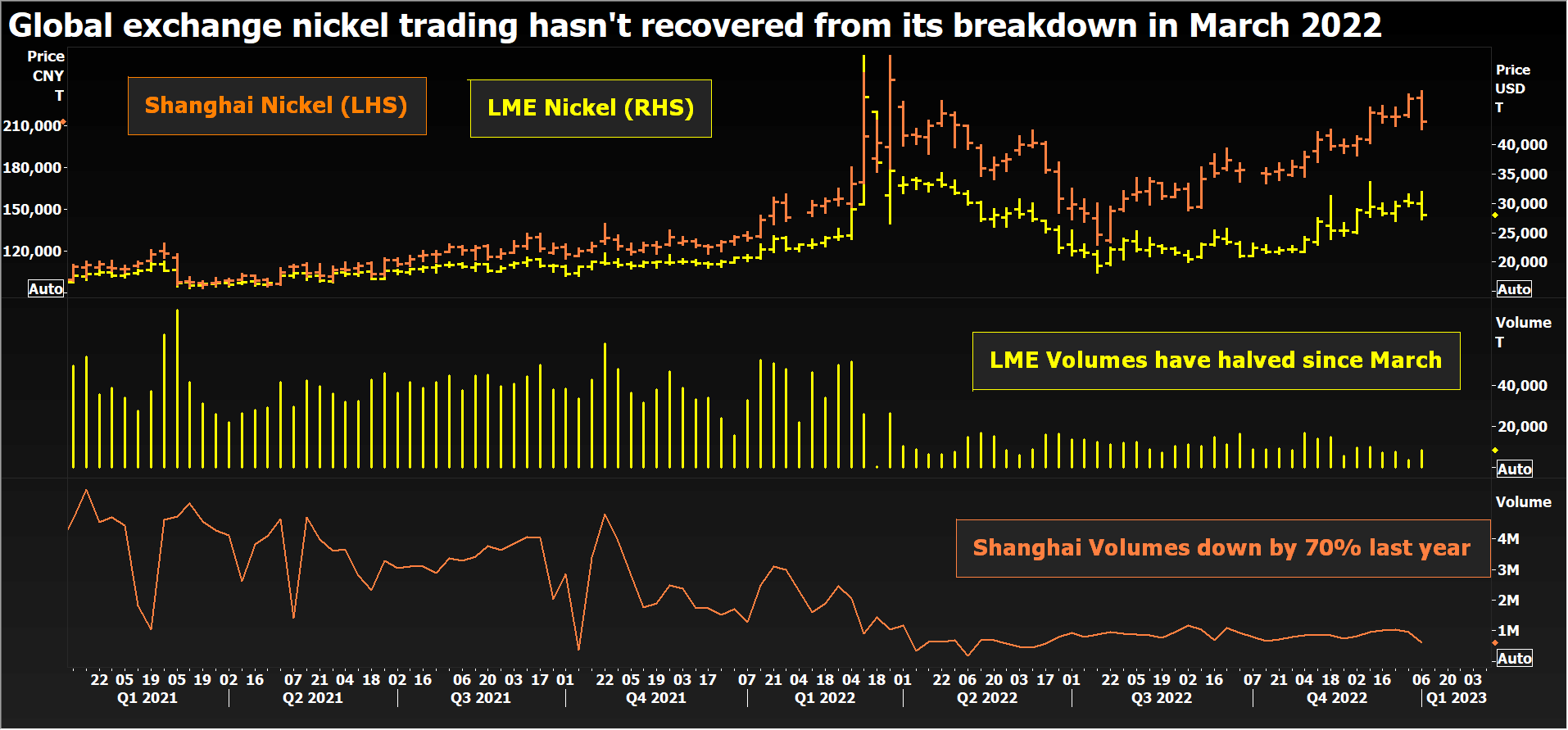

The global metal trade is usually priced according to the contracts of the London Metal Exchange (LME). However, the LME nickel trade experienced unprecedented volatility in March, forcing the exchange to suspend trading for a period of time, undermining market confidence and reducing liquidity to the lowest level in 10 years.

If the negotiations between Chinese buyers are successful, they will further damage the reputation of LME as a major global metal exchange. Chinese market participants said that the decline in liquidity, coupled with low inventories, led to the continued high prices in London this year, which did not reflect the market fundamentals.

A source from a large Chinese trading company said that due to the high price in London, the Chinese importers of metals mainly used for stainless steel production suffered heavy losses. The company is working with Nornickel GMKN of Russia The supply sources of MM negotiation in 2023 asked not to disclose their names, because they were not authorized to disclose to the media.

The LME spokesman did not directly comment on the negotiations, but said the exchange was taking measures to increase liquidity. A spokeswoman of LME said in an email to Reuters: “LME has recognized the market demand for reopening LME nickel trading in Asia, and we are giving priority to this, especially because it will revive arbitrage opportunities and help to recover liquidity.”.

The three sources said that Nornickel, the world’s largest refined nickel producer, offered a premium of more than 300 dollars per ton for the supply of full nickel plates in 2023, higher than the premium of 220 to 290 dollars per ton this year. Traditionally, this premium is paid on the basis of CMCU3, a three-month nickel price, for physical delivery to China.

A source from this large Chinese trading company said that if the seller insisted on using the LME price, it would reduce or cancel the purchase.

A source from another Chinese company said that other buyers also made the same request. Nornickel, the largest seller, declined to comment on the negotiations with Chinese buyers. A source with direct knowledge of the ongoing negotiations said that the seller planned to adhere to the LME price.

Tiger Shi, CEO of brokerage company BANDS Financial Limited, said that SHFE currently only allows registered Chinese entities to participate in its nickel trade, which reduces the possibility of sellers’ consent.

On Tuesday, LME Nickel CMNI3 closed at US $29271 per ton, down nearly half from the March high of US $55000, while SHFE Nickel SNICv1 traded at 209510 yuan (US $29994.27) per ton at 0212 GMT on Wednesday. LME is engaged in a legal war with American hedge funds, which seek to obtain a total of 472 million dollars in compensation for their decision to cancel nickel trading in March. The nickel price has soared more than 50% in a few hours, reaching a record level of more than 100000 dollars per ton.