1. The current market price of steel

On May 25, the domestic steel market fell mainly, and the ex-factory price of Tangshan billet was stable at 4,470 yuan/ton. Market sentiment eased, transactions improved, some speculative receipts entered the market, and transactions throughout the day increased slightly compared with the previous trading day.

On the 25th, the closing price of the main contract of the futures snail was 4541, down 0.24%, DEA and DIF were down, and the RSI third-line indicator was at 40-45, running between the middle and lower rails of the Bollinger Band. 21 steel mills lowered the ex-factory price of construction steel by 30-220 yuan/ton.

2. Market prices of four major varieties of steel

Construction steel: On May 25, the average price of 20mm grade 3 seismic rebar in 31 major cities across the country was 4,766 yuan/ton, down 32 yuan/ton from the previous trading day.

The market turnover remained weak in early trading, and the terminal had a strong wait-and-see mood, and the intraday price continued to loosen. In the afternoon, as the futures snails rebounded from oversold, the spot price stopped falling and stabilized.

In the short term, the recent demand continues to be sluggish, and the pressure on market inventory is gradually emerging. It is expected that the spot price of domestic construction steel will continue to weaken slightly on the 26th.

Hot-rolled coil: On May 25, the average price of 4.75mm hot-rolled coil in 24 major cities across the country was 4,865 yuan/ton, down 13 yuan/ton from the previous trading day.

The spot market price dropped slightly in early trading, and the market transaction was weak. In the late afternoon, the volume price rebounded from the bottom, the market price stabilized, and the merchants’ mood eased.

In general, the recent market trend is still weak, and market demand has not improved significantly. The overall pace of resumption of work in areas affected by the epidemic is slow, restraining the release of demand, and limited downstream procurement in the short term. It is expected that the national hot-rolled coil will fluctuate and weaken on the 26th.

Cold-rolled coil: On May 25, the average price of 1.0mm cold coil in 24 major cities across the country was 5,442 yuan/ton, down 18 yuan/ton from the previous trading day.

The market trading atmosphere is extremely deserted, and it is difficult for merchants to deliver goods. In the afternoon, some market prices were lowered again, but the market transactions still did not improve after the reduction.

The hot futures volume has continued to decline. Although there is a slight rebound, the downstream is more pessimistic about the market outlook, and the enthusiasm for purchasing is extremely poor. Near the end of the month, a new round of orders begins, and the current operations of various merchants are mainly to return funds.

In summary, it is expected that the price of cold-rolled coils in the domestic market may be weak on the 26th.

Medium and heavy plate: On May 25, the average price of 20mm common plate in 24 major cities across the country was 5,115 yuan/ton, down 19 yuan/ton from the previous trading day.

The market is mainly volatile, and the market mentality continues to be weak. In addition, the current downstream purchasing enthusiasm is not high, and most traders’ quotations gradually dropped slightly.

In terms of transactions, in the falling market, most market transactions performed poorly. In terms of resources, although the current north-south spread has been slightly repaired, most merchants are still relatively bearish about the market outlook, and they are not willing to take the initiative to stock up.

On the whole, the current market demand is still weak, and the price support is insufficient. It is expected that the national plate price will still be mainly adjusted on the 26th.

3. Market prices of raw materials and fuels

Scrap steel: The scrap steel market was weak on May 25. The average price of scrap steel in 45 major markets across the country was 3,198 yuan/ton, down 35 yuan/ton from the previous trading day.

Specifically, in the near future, when the current price of the finished product continues to be weak, the profits of steel mills have been continuously compressed, especially the short-process steel mills have entered a stage of overall loss.

Although the inventory of steel mills has declined as a whole, the number of days that can be used has not declined but has risen, which to a certain extent has restrained the price of scrap steel from stabilizing and rebounding.

At present, the only positive support for scrap steel prices is that the factory warehouse and social warehouse volume are both at a low level. It is expected that the short-term scrap steel price may remain weak.

Imported ore: On May 25, the spot market price of imported iron ore in Shandong was weak, and the market sentiment was acceptable.

Shandong area learned about some transactions: Qingdao Port: PB powder 950 yuan / ton (pre-sale), PB powder 955 yuan / ton, card powder 1150 yuan / ton; Rizhao Port: PB powder 950 yuan / ton, super special powder 755 yuan /Ton.

Coke: On May 25, the coke market was stable and weak. Most of the coke enterprises started construction at a high level, traders gradually received goods, and the coke inventory kept running at a low level.

The coke prices of some coke enterprises fell in three rounds, and their profits had fallen into losses, which increased the resistance to coke price cuts.

In terms of steel mills, the operating load of steel mills is high and stable, and daily consumption continues to rise.

Considering the meager profits of steel mills, the slowdown in finished product shipments and the lack of improvement in prices, the stock of raw materials is still controlled, and on-demand purchases are the mainstay, and the market is still rising by four. round expectations. In the short term, the coke market is stable and weak.

4. Steel market price forecast

According to data from the China Iron and Steel Association, the inventory of key steel companies in mid-May was close to 20 million tons, which has hit a new high this year, an increase of 36.5% over the same period last year.

The epidemic prevention and control measures in various places have combined with frequent rains in the south, and steel demand has remained weak since May.

At the same time, long-process steel mills have not yet seen concentrated production reductions, and independent electric arc furnace steel mills are gradually increasing production reduction efforts due to losses. Due to the slow improvement in demand, market confidence was hit again, and the steel futures and spot markets fell sharply on the 24th.

The pessimism in the market has eased today, and it is expected that the macro policy will further increase. Short-term steel prices may fluctuate weakly.

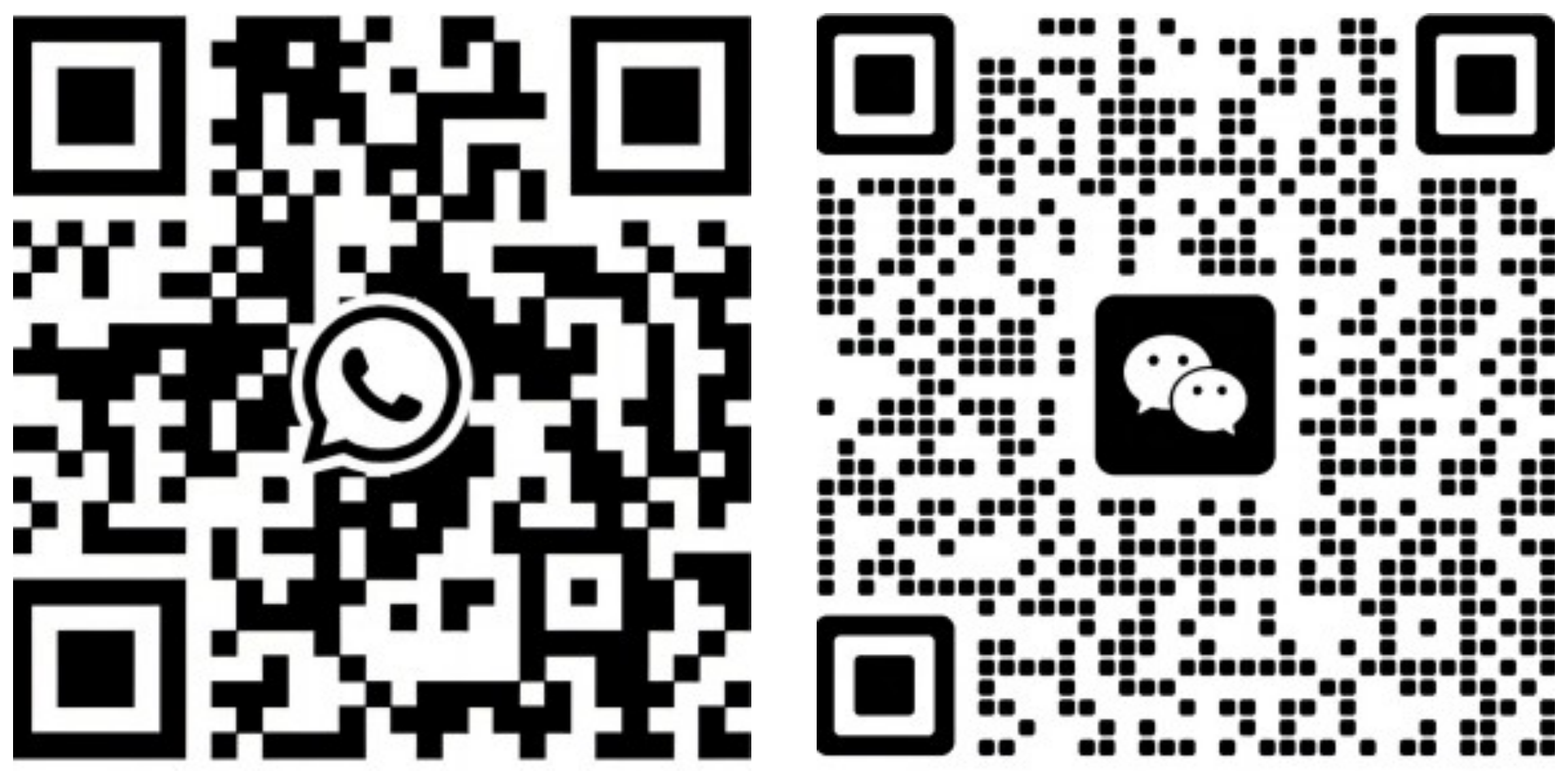

If you would like to know more, please ask our customer service.