1. Global steel trade trends

1) Russia and Ukraine suddenly cut off the supply of finished products to Europe

Directly affected by the geopolitical conflict, Ukrainian steel mills have suspended about 60% of steel production in the country, resulting in a supply gap of 15 million tons in the export market.

In 2021, Russia exported a total of 3.73 million tons of finished steel to the EU, while from January to November, Russia exported about 5.54 million tons of iron ore, 537,000 tons of pig iron and 3.384 million tons of steel billets to the EU.

In other words, regardless of transportation issues, the actual steel gap in Europe is around 3.7 million tons per year. As EU steel companies have faced soaring energy prices such as natural gas, electricity and crude oil since the second half of 2020.

Therefore, in the latest statement of sanctions against Russia, only the import of finished steel products is explicitly banned.

2) It is difficult for Ukrainian steel mills to resume production

The two leading steel mills in Ukraine both stated in early April that they would resume production within a month.

It is expected that the long-term loss of production will account for about 30%-40% of Ukraine’s total steel production capacity. Steel production reached 60%-70% of the normal period.

The Russian-Ukrainian conflict has indeed led to a certain supply shortage, and in some parts of Europe, it has caused serious supply problems due to countries that are highly dependent on Russia and Ukraine for imported resources.

However, the overall “disappearance” of the global supply chain only includes the part of Ukraine that was temporarily blocked due to the decline in production and the Black Sea trade.

The high level of global inflation triggered by the background of long-term monetary easing.

Therefore, there is no permanent supply shortage at present, and small-scale increments in other countries have basically made up for the gap left by the loss of production capacity in Ukraine. Black Sea export activity is now gradually recovering and is expected to reach normal levels in May.

2. Price trends of major global steel trade markets

1) Overseas steel prices generally rose

The prices of finished hot-rolled coil and rebar in the core global markets continued the steady-to-weake trend in the fourth quarter of last year in January, but the prices of semi-finished billets showed a continuous rise in the first quarter after bottoming out at the end of 2021.

During the Chinese Lunar New Year period, which began in early February, global steel prices returned to a volatile and rising range, and began to accelerate after the outbreak of the Russian-Ukrainian conflict at the end of February.

Throughout the first quarter, the prices of HRC imported from the United States, Europe and Southeast Asia increased by US$5/ton, US$400/ton and US$97/ton respectively.

The price increases of sheet metal in various regions are quite differentiated, and the supply problem has brought a lot of pressure to the direct import of the European market.

The strong difference between supply and demand also drove the FOB selling price in the direct source countries, among which the export price of Indian HRC rose by USD 452/ton in the first quarter.

In contrast, under the control of a series of currencies and import quotas in the United States, the cumulative increase in steel prices has been limited.

As of the beginning of April, it has not exceeded the historical high in August last year, while the steel prices in Europe and India have comprehensively exceeded new highs.

2) The increase of raw materials and semi-finished products is relatively large

In 2021, the steel billet exports of Russia and Ukraine will be about 15 million tons and 6.7 million tons respectively.

According to the rough calculation of the global semi-finished steel trade volume of 56.9 million tons in 2020, the total annual steel trade of these two countries will account for 38% of the world, of which 5 The above products are exported directly to Europe.

Many rolling mills in Central and Southern Europe have long purchased Black Sea steel slabs, especially slabs that are highly dependent on Russian resources.

As these rolling mills need to meet the reserves of basic raw materials, the CIF price of slabs at southern European ports reached more than US$1,000/ton at the end of March, which was once the same as the spot price of local HRC.

Although the EU has increased import quotas for some traditional supplying countries, the level of export supply from such countries is limited in the short term, and prices are rising very rapidly.

After these countries shifted their sales targets to Europe, the traditional Southeast Asian market also had to face the problem of tight supply.

3. Rebalancing of global steel trade

1) Russian steel exports to the West will be blocked for a long time

In April, the EU’s new steel import quota policy began to be implemented. From the current policy point of view, as of June 2024, finished steel (except semi-finished steel) originating in Russia will be banned from being exported to the EU.

The United States has also suspended the purchase of Russian steel, which previously purchased about 1.6 million tons of Russian steel each year, accounting for 5% of total imports.

In addition, the United States suspended 25% tariffs on steel products imported from the United Kingdom and 10% tariffs on aluminum products in March, allowing 500,000 tons of steel to be imported duty-free each year, and more than this amount of steel will be subject to tariffs.

The agreement will go into effect on June 1. It is worth noting that one of the agreements is also related to China.

Any British steel company owned by a Chinese entity must also be audited for its financial records, given that Chinese companies have bought British Steel, Britain’s second-largest steelmaker.

At the same time, the United States has also removed Russia from the International Funds Clearing System (SWIFT), which means that at least in the next two years, the export of Russian steel resources to European and American countries will face many obstacles.

3) Russian steel flows to the Middle East and Asia

Faced with severe sanctions, Russia has urgently stepped up sales in the Middle East, especially the Turkish market.

Since the beginning of March, Russia has exported a large amount of semi-finished products to Turkey, largely making up for the domestic steel supply gap in Turkey.

Long before the Russian-Ukrainian conflict, the epidemic and the expectation of a European carbon border tax prompted Russian steel mills to build a sales network in Asia, and steel exports to Asia also increased significantly.

Obviously, Russian steel mills did not reduce steel production because of the blockage of European sales channels, which accounted for more than 15% of their total sales, but actively sought alternative sales channels and ensured uninterrupted operation of blast furnaces.

4.The impact on China’s international steel trade

1) Promote short-term export of steel

In the first quarter, China’s domestic steel trade demand was under pressure, and the export of sheet products became the support point of domestic demand again, and the gate of billet export was reopened after a lapse of 10 years.

The main destination of China’s billet is Southeast Asian countries.

In the middle and late March, some slab resources completed export contracts to Italy, Spain, France and other European countries at relatively high prices, and the transaction prices were significantly higher than the mainstream prices in Asia.

The direct export of finished steel such as hot-rolled coils to Europe is still subject to quota restrictions, which has led to price differentiation in the export destination markets of different varieties. In March, the FOB price of Chinese slabs was once higher than that of hot-rolled coils.

Since March, the soaring steel price in Europe has also driven the price increase in the Middle East and India. The export price advantage of China’s flat products is obvious, and the steel export volume in the second quarter will increase significantly.

2) In the long run, it will help the import of multiple varieties in the industrial chain

This conflict has exacerbated the estrangement between Russia and Western countries, and the contradiction is difficult to resolve in the short term. Therefore, Russia’s export of steel, iron ore, scrap steel, coal and other products has to expand its sales to other countries.

Russia’s major large-scale steel mills have their own iron and coal mines, with low production costs and strong autonomy in the steel industry.

As a major resource-consuming country, China also needs stable overseas resource supply channels. Therefore, Russia has a high probability of using China as the main export market for steel-related products.

3) Promote the internationalization of RMB settlement of foreign trade in steel

In addition, since Russia was excluded from the SWIFT international steel trade payment system, Russia’s international steel trade with US dollars and euros as the settlement system has been greatly affected, but the bilateral trade relations between China and Russia have always maintained a friendly trend.

Since the fourth quarter of 2021, the current ratio of Russia’s RMB foreign exchange reserves has been the highest in the past five years, rising to the fifth place in the world.

Today, the two countries have begun to use RMB to settle energy trade, which can firstly bypass Western sanctions; and secondly, it can speed up the process of RMB internationalization.

It is believed that in the future Sino-Russian steel trade, the general use of RMB settlement will be the general trend.

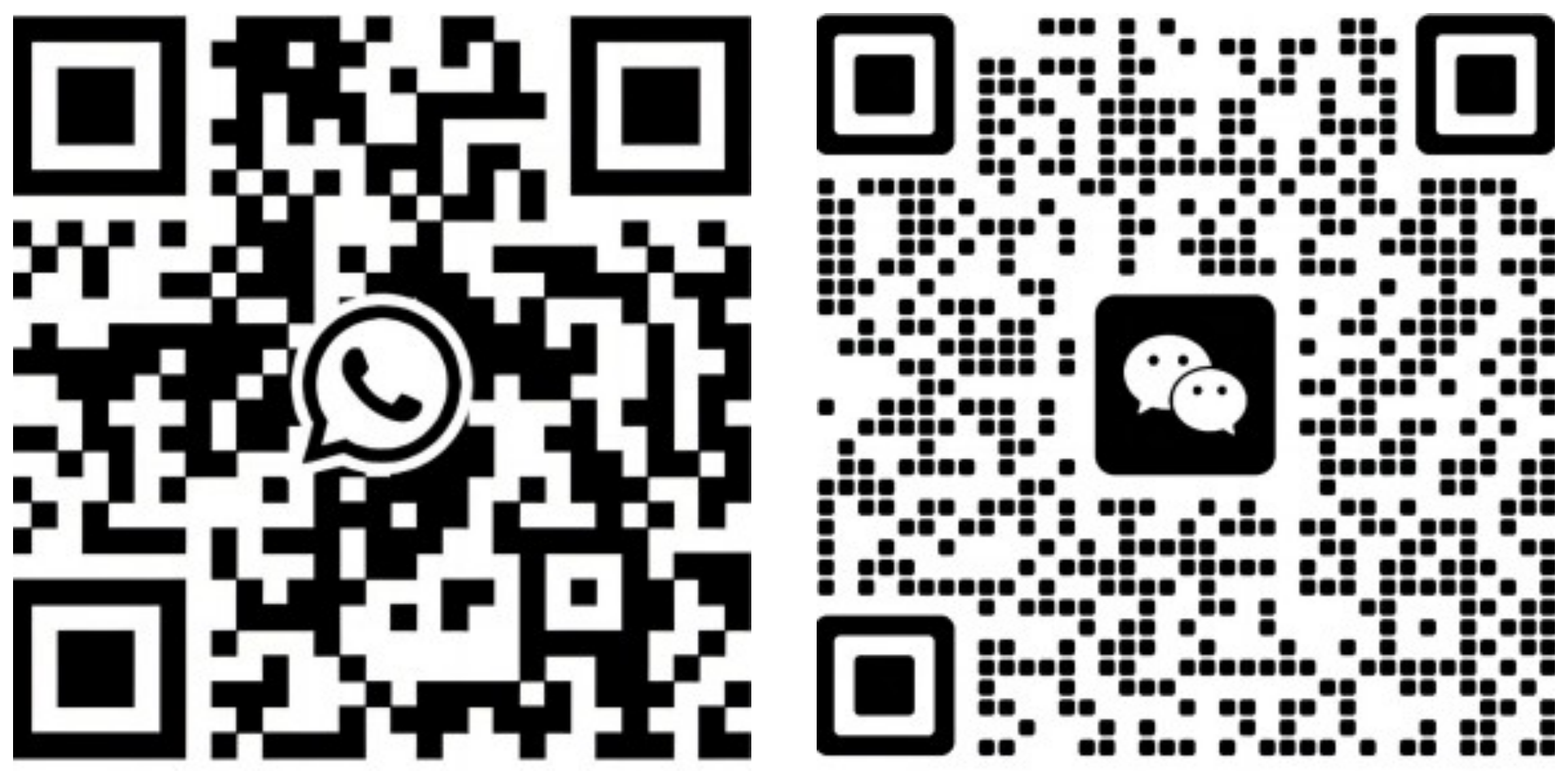

If you would like to know more, please ask our customer service.