On June 6, 2022, on the first day after the Dragon Boat Festival, Shanghai Nickel jumped up and opened, with an increase of more than 3% at one time, and then fell back in the afternoon. rose 1.14%.

After the opening of the London nickel market, after the 4-day holiday, the market immediately made up for the increase. At 15:30 Beijing time, it was reported to US$29,450/ton, an increase of US$1,180/ton from the closing on the 1st, an increase of 4.17%.

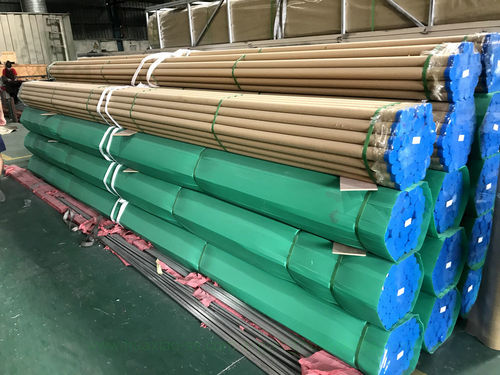

First, because the current domestic pure nickel inventory is still at a historically low position.

As of June 2, the domestic pure nickel social inventory was only 15,169 tons, including 2,077 tons of warehouse receipt inventory, 4,762 tons of spot inventory, and 8,330 tons of bonded area inventory.

The continuous low inventory since the end of April (the social inventory is less than 20,000 tons) has made the market increasingly worried about the future supply.

Second, the epidemic situation has improved, and the market has certain expectations for the increase in demand brought about by the resumption of work.

In June, Shanghai lifted the lockdown, and the operation of factories and enterprises and the logistics and transportation industry gradually resumed.

The domestic and foreign demand for ternary precursors continues to recover, and the overall market is developing well, which is transmitted upward to the increase in raw material procurement demand.

The recent drop in the price of nickel, cobalt and manganese salts also has a certain positive impetus for the recovery of the industry.

Inquiries in the ternary material market have increased, and the demand in the power market has improved. Small power and digital terminals are expected to pick up in the third quarter.

Third, the resonance effect of other commodity indices.

On the first day after the holiday, non-ferrous metals such as copper, aluminum and zinc, as well as ferrous metals such as stainless steel and iron ore, all rose, driving nickel prices to run strongly.

On the other hand, under the current strong nickel price, it should be noted that although pure nickel inventory is still at a historically low level, the spot consumption of pure nickel is extremely weak.

Market spot premiums and discounts fell again and again. At the end of May, numerous nickel plates were delivered as warehouse receipts due to poor transactions, which made low-level inventories a rare replenishment.

In addition, the new energy industry is recovering, but at the same time, nickel intermediate products are also imported and returned, and the future price of nickel salt will weaken due to the increase in the supply of raw materials.

The demand for nickel raw materials in the stainless steel industry is even more sluggish. In June, domestic 300-series stainless steel plants are expected to reduce crude steel production by 70,000 to 100,000 tons, and the focus of the ferronickel market continues to move downward.

Huaxia Steel believes that nickel prices will still have a certain high level of support in the short term, but the negative risks cannot be ignored.