As a green product with a full life cycle, what will be the performance of stainless steel products in 2022 under the vision of dual energy consumption control and “dual carbon goals”?

On the basis of industry tracking and policy understanding, Huaxia Metal communicates with fellow people in the ss industry to discuss the future development trend of domestic stainless steel.

According to data from the Win-Win Report Network, China’s crude stainless steel output will reach 30.632 million tons in 2021, an increase of 490,000 tons compared with 2020, a year-on-year increase of 1.64%.

Among them, the output of Cr-Ni steel (300 series) completed 15.067 million tons, accounting for 49.19% of the total output of stainless steel crude steel in the country, accounting for the largest proportion.

The output of Cr-Mn steel (200 series) completed 9.058 million tons, accounting for 29.57% of the total output of stainless steel crude steel in the country.

The output of Cr steel (400 series) completed 6.2670 million tons, accounting for 20.46% of the total output of stainless crude steel in the country. The output of duplex ss was 240,600 tons, accounting for 0.79% of the total output of crude stainless steel in the country.

From the perspective of key stainless steel enterprises, after years of development, Chinese ss production enterprises have blossomed everywhere, and many excellent stainless steel production enterprises have risen rapidly and gradually become leaders in the stainless steel industry.

Such as Taigang Stainless Steel, Jiugang Hongxing, Yongjin Co., Ltd., etc. , from the time of establishment and listing, TISCO Stainless was established and listed earlier than Jiugang Hongxing and Yongjin Co., Ltd. TISCO Stainless is headquartered in Shanxi, Jiugang Hongxing is headquartered in Gansu, Yongjin Co., Ltd. Headquartered in Zhejiang.

Stainless prices will remain high in all regions in 2021. The European 304 CRC base price is now equal to the record high recorded in January 2007. Stainless steel prices in the US are also at their highest level in 14 years.

Nonetheless, the forward-looking view on global prices has gradually become more pessimistic, especially for coil products, which have risen the most recently. However, prices are expected to fall more slowly than they have risen over the past twelve months.

In Asia, expected declines in raw material costs, coupled with subdued seasonal demand, could put negative pressure on sales values ahead of Chinese New Year. However, production cuts in the region should limit supply and limit the magnitude of any price declines.

By the first half of February 2022, the total stainless steel market inventory was 802,300 tons, an increase of 150,700 tons compared with the second half of January, a month-on-month increase of 23.13%, and a year-on-year decrease of 0.39%.

From the data point of view, the recent increase in inventory is more obvious, but it is especially weak compared with the same period last year.

In terms of application fields, the largest application field of stainless steel in my country is the manufacture of metal products, accounting for about 28% of the total stainless steel usage.

This is followed by the construction sector for housing construction, large buildings and other public facilities, accounting for about 25%. The proportion of stainless steel used in large-scale resource mining such as petrochemical and coal and construction machinery such as marine engineering is also relatively high, about 18%.

In addition, stainless steel also has a certain proportion in other transportation, electrical machinery, and motor vehicles and components, which are 11%, 11%, and 7% respectively. The total demand for stainless steel in the manufacturing industry accounts for 75%, which is very different from the construction industry is the main downstream plain steel.

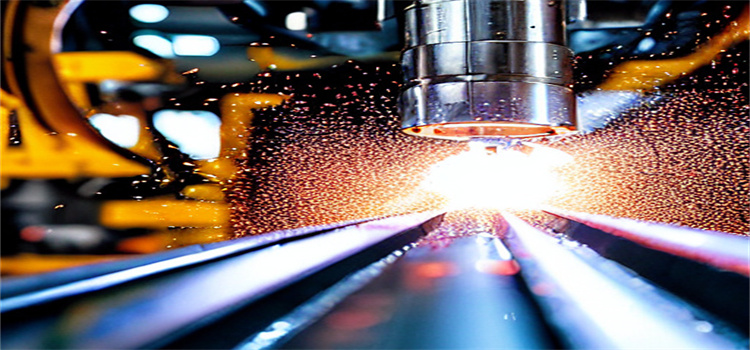

With the upgrading of product structure in military industry and high-end manufacturing industry, the proportion of high-end stainless steel in these two fields will gradually expand in the future.

Further, gains in the North American base in the first half of 2022 are expected to be limited by reduced purchasing activity. In addition, distributors have ordered many materials from domestic and foreign suppliers. This will start to appear in early 2022.

Supply from domestic stainless producers is expected to remain constrained. This will help keep the price higher in the short term. European trade in flat products is expected to pick up early in the new year, especially for cold rolled coil and sheet, where supplies remain tight.

But stainless steel stocks are increasing in most grades and sizes. This, combined with weaker demand, is expected to limit the level of price increases that stainless buyers are prepared to accept during this period.